Understanding Closing Costs for VA Loans: A Comprehensive Guide to Save You Money

#### Closing Costs VA LoanWhen it comes to purchasing a home with a VA loan, understanding the **closing costs VA loan** is crucial for veterans and active……

#### Closing Costs VA Loan

When it comes to purchasing a home with a VA loan, understanding the **closing costs VA loan** is crucial for veterans and active-duty service members. VA loans are a fantastic benefit offered by the U.S. Department of Veterans Affairs, allowing eligible individuals to buy homes with favorable terms. However, like any mortgage, VA loans come with associated costs that need to be considered.

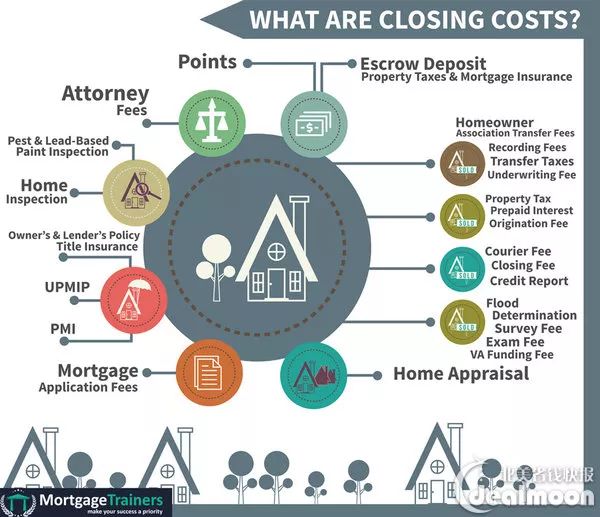

#### What Are Closing Costs?

Closing costs refer to the fees and expenses that buyers must pay when finalizing a real estate transaction. These costs can include a variety of charges, such as loan origination fees, appraisal fees, title insurance, and recording fees. For VA loans, the closing costs typically range from 3% to 5% of the purchase price of the home.

#### Breakdown of Closing Costs for VA Loans

1. **Loan Origination Fee**: This is a fee charged by the lender for processing the loan application. While VA loans limit this fee to 1% of the loan amount, some lenders may charge less.

2. **Appraisal Fee**: Before approving a VA loan, lenders require a property appraisal to ensure the home is worth the purchase price. The cost of the appraisal can vary, but it typically ranges from $400 to $600.

3. **Title Insurance**: This protects the lender and the buyer from any legal claims against the property. The cost can vary based on the location and the price of the home.

4. **Recording Fees**: These are fees charged by the local government to record the new ownership of the property. These fees can vary significantly depending on the county.

5. **Prepaid Costs**: These include items like property taxes and homeowners insurance that are paid in advance at closing.

6. **VA Funding Fee**: This is a one-time fee that helps sustain the VA loan program. The amount varies based on the type of service and whether it’s the borrower’s first use of a VA loan.

#### Are Closing Costs Negotiable?

One of the appealing aspects of VA loans is that many of the closing costs can be negotiated. Buyers can ask sellers to cover some or all of the closing costs, which can significantly reduce the amount of cash needed at closing. Additionally, some lenders offer to roll closing costs into the loan amount, although this may increase the overall loan balance and monthly payments.

#### How to Estimate Closing Costs

To get a better understanding of what to expect, it’s advisable to request a Loan Estimate from your lender. This document provides a detailed breakdown of all estimated closing costs, giving you a clearer picture of what you’ll need to pay at closing.

#### Conclusion

Understanding **closing costs VA loan** is essential for any veteran or service member looking to buy a home. By being aware of the various fees involved and knowing that many costs can be negotiated or minimized, you can save money and make the home-buying process smoother. Always consult with your lender and consider seeking advice from a real estate professional to ensure you are fully informed and prepared for the financial aspects of your home purchase.