How to Take a Loan from Life Insurance: Your Ultimate Guide to Financial Freedom

When it comes to managing your finances, understanding how to take a loan from life insurance can be a game-changer. Life insurance isn’t just a safety net……

When it comes to managing your finances, understanding how to take a loan from life insurance can be a game-changer. Life insurance isn’t just a safety net for your loved ones; it can also serve as a valuable financial tool during your lifetime. This comprehensive guide will walk you through the process, benefits, and considerations of taking a loan against your life insurance policy.

### What is a Life Insurance Loan?

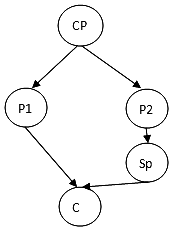

A life insurance loan allows policyholders to borrow against the cash value of their permanent life insurance policies, such as whole or universal life insurance. Unlike traditional loans, you don’t need to undergo a credit check, and the approval process is typically faster. The amount you can borrow is usually a percentage of the cash value accumulated in your policy.

### Why Consider a Loan from Life Insurance?

1. **No Credit Check Required**: One of the most appealing aspects of taking a loan from your life insurance policy is that it doesn’t affect your credit score. This is particularly advantageous for individuals who may have poor credit or are in the process of rebuilding their credit history.

2. **Flexible Repayment Options**: Unlike conventional loans, where you must adhere to strict repayment schedules, life insurance loans offer flexibility. You can repay the loan on your terms, and if you choose not to repay it, the outstanding amount will simply be deducted from your death benefit.

3. **Tax Advantages**: In many cases, the money you borrow from your life insurance policy is tax-free, provided you repay the loan. This can be an excellent way to access funds without incurring tax liabilities.

### Steps to Take a Loan from Life Insurance

1. **Understand Your Policy**: Before taking a loan, review your life insurance policy to determine the cash value available for borrowing. Not all policies build cash value, so ensure you have a permanent life insurance policy that qualifies.

2. **Contact Your Insurance Provider**: Reach out to your insurance company or agent to discuss your options. They can provide you with the necessary forms and information regarding the loan process.

3. **Complete the Application**: Fill out the loan application, specifying the amount you wish to borrow. Be prepared to provide details about your policy and the purpose of the loan, if required.

4. **Receive Your Funds**: Once your application is approved, the funds will be disbursed to you, usually in the form of a check or direct deposit.

5. **Manage Your Loan**: Keep track of the loan amount and any interest accrued. While repayment is flexible, remember that unpaid loans will reduce your death benefit.

### Considerations Before Taking a Loan

- **Impact on Death Benefit**: Keep in mind that any outstanding loan amount will be deducted from your death benefit, potentially leaving your beneficiaries with less financial support.

- **Interest Rates**: Life insurance loans typically have lower interest rates compared to personal loans, but it’s essential to understand the terms and conditions associated with your specific policy.

- **Potential Policy Lapse**: If you take a significant loan and do not repay it, there’s a risk that your policy could lapse, leaving you without coverage.

### Conclusion

Learning how to take a loan from life insurance can empower you to make informed financial decisions. Whether you need funds for an emergency, a major purchase, or to consolidate debt, a life insurance loan can provide the financial flexibility you need. Always consult with a financial advisor or insurance professional to ensure that this option aligns with your long-term financial goals. By leveraging the cash value of your life insurance policy, you can unlock a world of financial opportunities while securing your family’s future.