### Discover the Best Auto Loan Rates Austin Texas for Your Next Dream Car!

When it comes to purchasing a vehicle, understanding the financing options available to you is crucial. One of the most significant factors in determining t……

When it comes to purchasing a vehicle, understanding the financing options available to you is crucial. One of the most significant factors in determining the total cost of your vehicle is the auto loan rates Austin Texas offers. In this guide, we will explore the various aspects of auto loans, how to find the best rates, and what you need to consider when financing your vehicle in Austin, Texas.

#### Understanding Auto Loan Rates

Auto loan rates can vary significantly based on several factors, including your credit score, the type of vehicle you are purchasing, and the lender you choose. In Austin, Texas, the competitive market means that consumers have a range of options when it comes to securing an auto loan.

Typically, auto loan rates are expressed as an annual percentage rate (APR), which represents the cost of borrowing money over a year. A lower APR means you will pay less in interest over the life of the loan, making it crucial to shop around for the best auto loan rates Austin Texas has to offer.

#### Factors Influencing Auto Loan Rates

1. **Credit Score**: Your credit score is one of the most critical factors lenders consider when determining your interest rate. A higher score usually translates to lower rates. If your score is less than stellar, consider taking steps to improve it before applying for a loan.

2. **Loan Term**: The length of the loan can also affect your interest rate. Generally, shorter loan terms come with lower rates, but higher monthly payments. Conversely, longer terms may have higher rates but lower monthly payments.

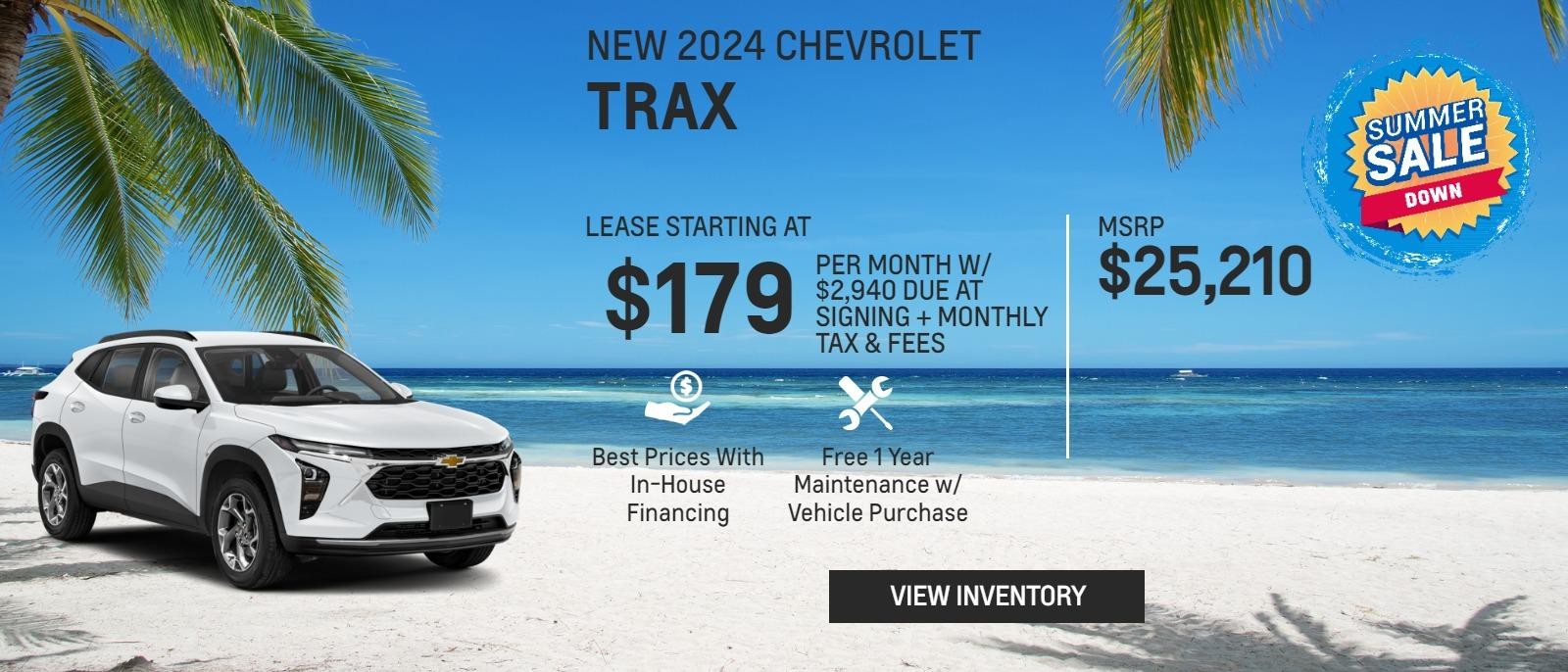

3. **Vehicle Type**: New cars often come with lower interest rates compared to used cars. Some lenders offer promotional rates for specific models, so it's worth checking if the vehicle you're interested in qualifies for any discounts.

4. **Down Payment**: Making a substantial down payment can help reduce your loan amount, which may lead to better interest rates. It also shows lenders that you are financially responsible.

#### How to Find the Best Auto Loan Rates in Austin

1. **Research Lenders**: Start by researching various lenders, including banks, credit unions, and online lenders. Each may offer different rates and terms, so it's essential to compare.

2. **Pre-Approval**: Consider getting pre-approved for an auto loan. This process allows you to understand your budget and gives you leverage when negotiating with dealers.

3. **Use Online Tools**: Many websites provide tools to compare auto loan rates from different lenders. Utilize these resources to find the best options available in Austin.

4. **Negotiate**: Don’t hesitate to negotiate the terms of your loan. If you find a better rate elsewhere, use that information to your advantage.

#### Benefits of Finding the Best Auto Loan Rates

Securing a low-interest rate on your auto loan can save you significant money over the life of the loan. For example, a difference of just a few percentage points can lead to hundreds or even thousands of dollars in savings. Additionally, lower monthly payments can free up your budget for other expenses, making it easier to manage your finances.

#### Conclusion

In conclusion, understanding and finding the best auto loan rates Austin Texas offers is a vital step in the car buying process. By considering factors like your credit score, loan term, and vehicle type, you can position yourself to secure the most favorable rates available. Don’t forget to shop around, get pre-approved, and negotiate to ensure you get the best deal possible. With the right information and preparation, you can drive away in your dream car without breaking the bank!