"Personal Loans Fort Worth TX: Discover the Best Options for Your Financial Needs"

Guide or Summary:Personal Loans are an essential financial tool for individuals looking to access quick cash for a variety of purposes, from consolidating d……

Guide or Summary:

- Personal Loans are an essential financial tool for individuals looking to access quick cash for a variety of purposes, from consolidating debt to funding a major purchase. In Fort Worth, TX, there are several reputable lenders offering personal loans tailored to meet the diverse needs of the local community. This guide will explore the best options available for those seeking personal loans in Fort Worth, TX, helping you make an informed decision that aligns with your financial goals.

- Fort Worth, TX is a vibrant city known for its rich cultural heritage, thriving economy, and diverse population. Located in the heart of Tarrant County, Fort Worth is a bustling metropolis that offers a plethora of opportunities for residents and visitors alike. Whether you're a long-time resident or a newcomer to the area, access to financial resources is crucial for navigating the challenges and taking advantage of the opportunities that Fort Worth has to offer.

- Discover the Best Options for Your Financial Needs When it comes to personal loans in Fort Worth, TX, there are several factors to consider when choosing the right lender and loan product for your specific needs. Here are some key considerations to keep in mind:

Personal Loans are an essential financial tool for individuals looking to access quick cash for a variety of purposes, from consolidating debt to funding a major purchase. In Fort Worth, TX, there are several reputable lenders offering personal loans tailored to meet the diverse needs of the local community. This guide will explore the best options available for those seeking personal loans in Fort Worth, TX, helping you make an informed decision that aligns with your financial goals.

Fort Worth, TX is a vibrant city known for its rich cultural heritage, thriving economy, and diverse population. Located in the heart of Tarrant County, Fort Worth is a bustling metropolis that offers a plethora of opportunities for residents and visitors alike. Whether you're a long-time resident or a newcomer to the area, access to financial resources is crucial for navigating the challenges and taking advantage of the opportunities that Fort Worth has to offer.

Discover the Best Options for Your Financial Needs When it comes to personal loans in Fort Worth, TX, there are several factors to consider when choosing the right lender and loan product for your specific needs. Here are some key considerations to keep in mind:

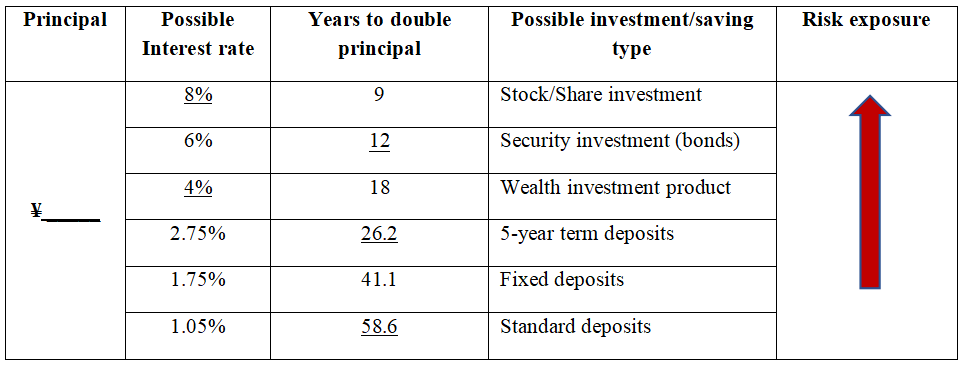

1. **Interest Rates and Fees**: Compare the interest rates and fees associated with different personal loan options. Look for lenders that offer competitive rates and transparent fee structures.

2. **Loan Amounts and Terms**: Determine the amount of money you need and the terms that work best for your financial situation. Consider the loan term, repayment schedule, and any prepayment penalties.

3. **Credit Score and Credit History**: Your credit score and credit history will play a significant role in determining your eligibility for a personal loan and the interest rates you may qualify for. A good credit score can help you secure a lower interest rate and more favorable loan terms.

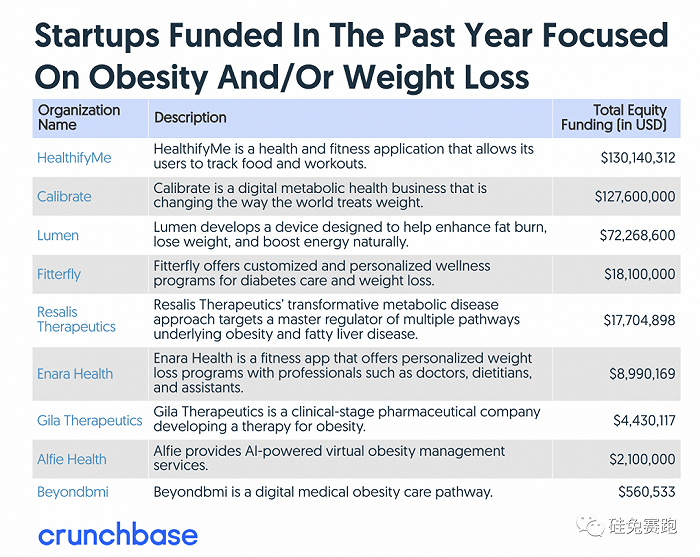

4. **Reputation and Customer Service**: Research the reputation of the lenders you are considering. Look for reviews from other customers and check the lender's rating with the Better Business Bureau (BBB). Additionally, consider the level of customer service provided by the lender.

5. **Additional Features and Benefits**: Some personal loan options may offer additional features and benefits, such as flexible repayment options, automatic payments, or cash advances. Consider what features and benefits would be most beneficial to your financial situation.

In conclusion, accessing the right personal loan in Fort Worth, TX, can provide you with the financial flexibility and support you need to achieve your goals. By carefully considering your options and choosing a lender that aligns with your financial needs and goals, you can secure a personal loan that meets your specific requirements. Remember to compare interest rates, fees, loan amounts, and terms, and to consider your credit score and credit history when making your decision. With the right personal loan, you can take control of your finances and enjoy the financial freedom that comes with it.