Mortgage Payment Calculator VA Loan

Guide or Summary:VeteransActive-Duty Military MembersUnderstanding the Benefits of a VA LoanComparison with Traditional MortgagesNavigating the complex worl……

Guide or Summary:

- Veterans

- Active-Duty Military Members

- Understanding the Benefits of a VA Loan

- Comparison with Traditional Mortgages

Navigating the complex world of mortgages can often feel like walking through a maze. With countless variables and acronyms to remember, it's no wonder many borrowers feel overwhelmed. Enter the mortgage payment calculator VA loan, a powerful tool designed to simplify the mortgage process for veterans and active-duty military members. This comprehensive calculator offers a straightforward approach to understanding the financial implications of a VA loan, making it easier to compare options and make informed decisions.

Veterans

For veterans, the VA loan is more than just a financial tool; it's a testament to their service and sacrifice. The mortgage payment calculator VA loan is designed specifically to assist these brave men and women in achieving homeownership. With competitive interest rates and flexible terms, a VA loan can be a significant advantage for veterans looking to purchase a home. The calculator helps users estimate their monthly mortgage payments, including principal, interest, taxes, and insurance, allowing them to plan their budget accordingly.

Active-Duty Military Members

Active-duty military members face unique challenges when it comes to homeownership. The mortgage payment calculator VA loan is designed to address these challenges head-on. Whether you're looking to buy a home in a new city or dealing with the uncertainties of military life, this calculator can help you navigate the process with confidence. By providing accurate and up-to-date information, the mortgage payment calculator VA loan ensures that you're making informed decisions about your financial future.

Understanding the Benefits of a VA Loan

One of the most compelling aspects of the VA loan is its flexibility. Unlike traditional mortgages, VA loans do not require a down payment, making it easier for borrowers to enter the housing market. Additionally, the loan is backed by the U.S. Department of Veterans Affairs, providing an added layer of security and stability.

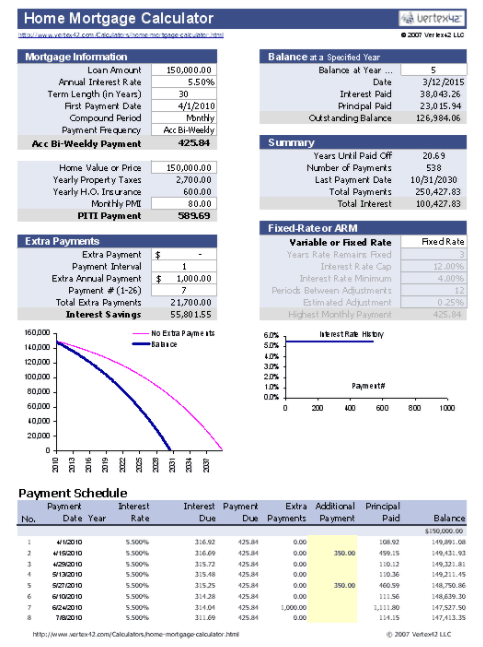

The mortgage payment calculator VA loan is designed to help borrowers understand the full financial picture associated with a VA loan. By inputting various factors such as the loan amount, interest rate, and term length, users can receive a detailed breakdown of their monthly payments. This information is crucial for budgeting and financial planning, ensuring that borrowers are fully prepared for the commitment of homeownership.

Comparison with Traditional Mortgages

When comparing the mortgage payment calculator VA loan to traditional mortgages, it's important to consider the unique benefits and features of each option. Traditional mortgages typically require a down payment, which can be a significant barrier for many borrowers. Additionally, traditional mortgages do not offer the same level of flexibility or financial support as a VA loan.

The mortgage payment calculator VA loan is a powerful tool for anyone looking to purchase a home. By providing accurate and comprehensive information, this calculator helps borrowers make informed decisions about their financial future. Whether you're a veteran, active-duty military member, or simply looking for a reliable mortgage option, the mortgage payment calculator VA loan is worth exploring. With its user-friendly interface and valuable insights, this calculator is sure to be a valuable asset in your journey to homeownership.