Government Student Loan Payments: Maximizing Your Financial Aid Potential

Guide or Summary:Understanding Government Student Loan PaymentsMaximizing Your Financial Aid PotentialIn the ever-evolving landscape of higher education, th……

Guide or Summary:

In the ever-evolving landscape of higher education, the role of government student loan payments cannot be understated. These payments form the backbone of financial aid for millions of students across the United States, enabling access to the education they need to secure a brighter future. By understanding the intricacies of government student loan payments, students can make informed decisions that maximize their financial aid potential, reduce debt, and set themselves up for long-term financial success.

Understanding Government Student Loan Payments

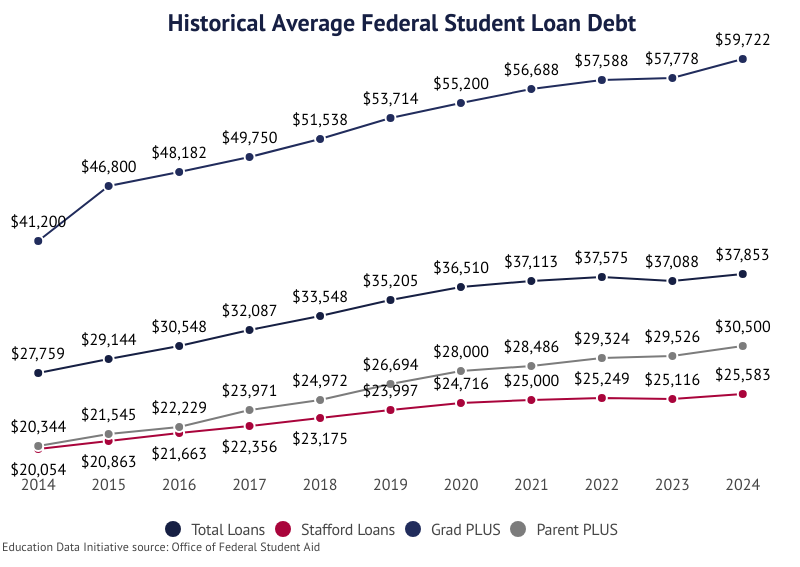

Government student loan payments are designed to make higher education more accessible to students from diverse economic backgrounds. These loans come in various forms, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Plus Loans for Parents. Each type of loan has its own eligibility criteria, interest rates, and repayment terms, making it essential for students to research and understand their options thoroughly.

Maximizing Your Financial Aid Potential

Maximizing your financial aid potential involves leveraging all available resources to reduce the amount of debt you accrue. Here are some strategies to consider:

1. **Apply Early and Completely**: Submit your Free Application for Federal Student Aid (FAFSA) early to ensure you receive all available grants and loans. Ensure all information is accurate and complete to avoid delays or denials in your aid package.

2. **Explore All Financial Aid Opportunities**: Beyond government student loans, there are numerous scholarships, grants, and work-study programs available. Research and apply for these opportunities to supplement your financial aid package.

3. **Consider Your Repayment Terms**: When selecting government student loans, weigh the pros and cons of different repayment plans, such as income-driven repayment plans, which can adjust your monthly payments based on your income and family size.

4. **Refinance Student Loans Wisely**: If you have multiple student loans, consider refinancing them to secure a lower interest rate. However, be cautious as refinancing federal loans may result in the loss of certain benefits, such as income-driven repayment plans and loan forgiveness programs.

5. **Utilize Loan Forgiveness Programs**: Take advantage of loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which can forgive remaining loan balances after working in qualifying public service positions for a certain number of years.

Government student loan payments play a crucial role in making higher education accessible and affordable. By understanding the options available and strategically maximizing your financial aid potential, you can reduce debt, achieve your educational goals, and set a strong foundation for your financial future. Remember, the key to successful student loan management lies in informed decision-making and proactive planning. Start today by exploring your options and making the most of the resources available to you. Your future self will thank you.