Exploring the USDA Loans Eligibility Map: A Comprehensive Guide to Home Financing Options

#### Understanding USDA LoansUSDA loans, backed by the United States Department of Agriculture, are designed to promote homeownership in rural areas. These……

#### Understanding USDA Loans

USDA loans, backed by the United States Department of Agriculture, are designed to promote homeownership in rural areas. These loans offer several benefits, including no down payment, competitive interest rates, and lower mortgage insurance costs. However, eligibility for these loans is primarily determined by geographic location and income limits, making the USDA Loans Eligibility Map an essential tool for potential homebuyers.

#### The Importance of the USDA Loans Eligibility Map

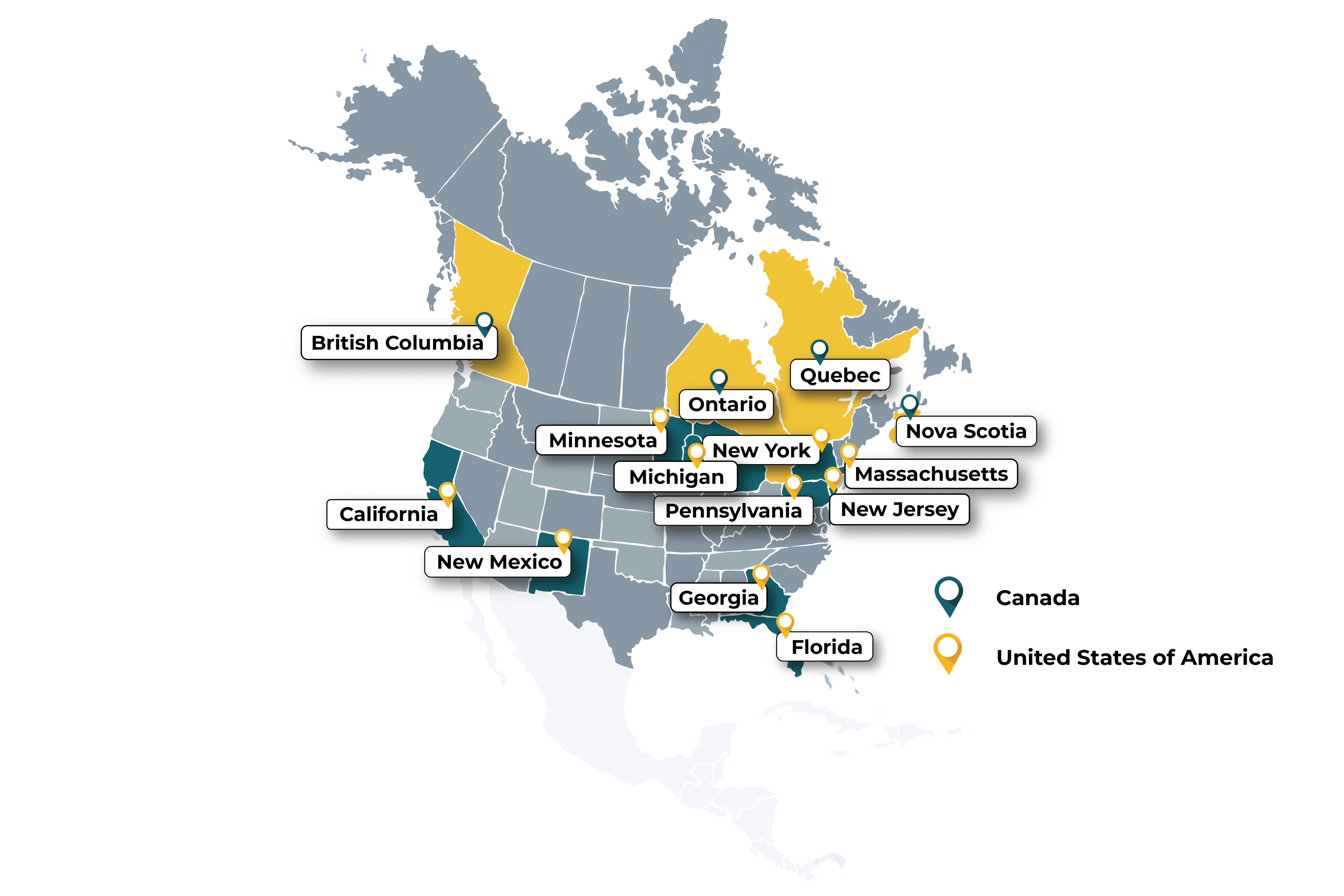

The USDA Loans Eligibility Map is a crucial resource for anyone considering a USDA loan. It visually represents areas that qualify for these loans, helping potential borrowers identify whether their desired location falls within the eligible zones. This map is particularly useful for first-time homebuyers looking to purchase a home in rural or suburban areas where traditional financing options may be limited.

#### How to Use the USDA Loans Eligibility Map

Using the USDA Loans Eligibility Map is straightforward. Homebuyers can access the map through the USDA's official website. Once there, users can enter their desired address or navigate the map to see if the location is eligible for USDA financing. The map highlights eligible areas in different colors, making it easy to distinguish between qualifying and non-qualifying regions.

#### Eligibility Criteria for USDA Loans

While the map is a vital tool, understanding the eligibility criteria is equally important. To qualify for a USDA loan, applicants must meet specific requirements, including:

1. **Location**: The property must be located in a designated rural area as indicated on the USDA Loans Eligibility Map.

2. **Income Limits**: Borrowers must have a household income that does not exceed 115% of the median income for the area.

3. **Creditworthiness**: While USDA loans are more lenient than conventional loans, a credit score of at least 640 is generally recommended.

4. **Primary Residence**: The home must be intended as the borrower's primary residence.

#### Benefits of Using the USDA Loans Eligibility Map

The USDA Loans Eligibility Map offers numerous advantages for potential homebuyers:

- **Visual Representation**: The map provides a clear visual representation of eligible areas, making it easier for buyers to identify suitable locations.

- **Informed Decision-Making**: By understanding where they can purchase homes with USDA loans, buyers can make more informed decisions about their home search.

- **Access to Resources**: The map often links to additional resources, such as local lenders and USDA offices, which can assist buyers in the loan application process.

#### Conclusion

In conclusion, the USDA Loans Eligibility Map is an invaluable tool for aspiring homeowners looking to take advantage of USDA financing. By understanding how to navigate the map and the eligibility criteria, potential borrowers can unlock opportunities for affordable homeownership in rural areas. Whether you are a first-time buyer or looking to relocate, the USDA Loans Eligibility Map can guide you toward making your dream of homeownership a reality.