Unlock Fast Cash with Tennessee Title Loans in Bristol, Tennessee

#### IntroductionIf you find yourself in need of quick cash, **Tennessee title loans in Bristol, Tennessee** offer a convenient solution. These loans allow……

#### Introduction

If you find yourself in need of quick cash, **Tennessee title loans in Bristol, Tennessee** offer a convenient solution. These loans allow you to leverage the equity in your vehicle to secure funds rapidly, making them an attractive option for those facing financial emergencies.

#### What are Tennessee Title Loans?

Tennessee title loans are secured loans that use your vehicle's title as collateral. This means that the lender holds the title until the loan is repaid. The amount you can borrow typically depends on the value of your vehicle, allowing you to access a significant sum of money quickly.

#### Benefits of Choosing Tennessee Title Loans in Bristol, Tennessee

1. **Quick Approval Process**: One of the main advantages of title loans is the speed at which you can receive funds. Many lenders in Bristol offer same-day approvals, allowing you to get the cash you need without lengthy waiting periods.

2. **No Credit Check Required**: Unlike traditional loans that require a credit check, title loans focus on the value of your vehicle. This makes them accessible to individuals with poor credit histories who may struggle to secure financing through conventional means.

3. **Keep Your Vehicle**: With Tennessee title loans, you can continue to drive your vehicle while repaying the loan. This flexibility is especially beneficial for those who rely on their cars for daily transportation.

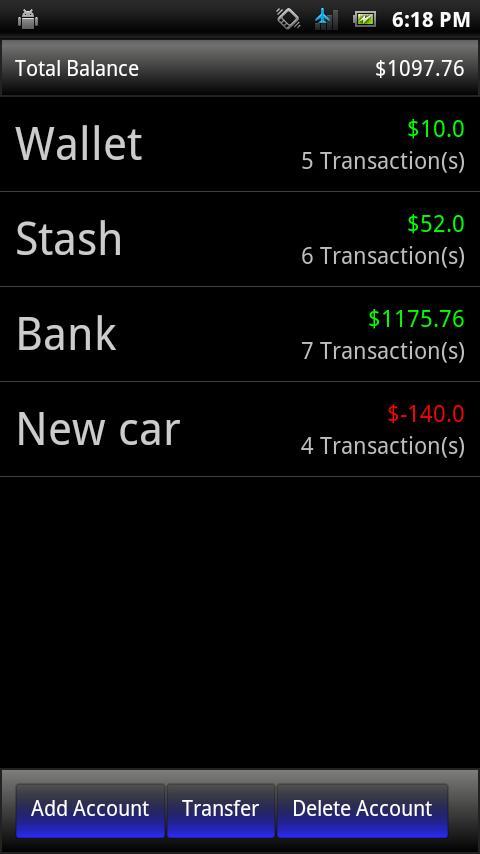

4. **Flexible Loan Amounts**: Depending on the equity in your vehicle, you can borrow anywhere from a few hundred to several thousand dollars. This range allows you to choose a loan amount that fits your specific financial needs.

#### How to Apply for Tennessee Title Loans in Bristol, Tennessee

1. **Gather Required Documents**: To start the application process, you'll need to provide your vehicle's title, proof of identity, and proof of income. Having these documents ready can expedite the approval process.

2. **Find a Reputable Lender**: Research local lenders in Bristol that offer title loans. Look for reviews and testimonials to ensure you choose a trustworthy provider.

3. **Complete the Application**: Most lenders provide online applications, making it easy to apply from the comfort of your home. Fill out the required information and submit your documents.

4. **Receive Your Funds**: Once approved, you can receive your funds in cash or through a direct deposit to your bank account. The speed of this process is one of the key benefits of title loans.

#### Considerations Before Taking Out a Title Loan

While Tennessee title loans can be a great solution for immediate cash needs, it's essential to consider the following:

- **Interest Rates**: Title loans often come with higher interest rates compared to traditional loans. Make sure to understand the terms and calculate the total cost of borrowing.

- **Repayment Terms**: Be aware of the repayment schedule and ensure you can meet the payments to avoid losing your vehicle.

- **Alternatives**: Consider other borrowing options, such as personal loans or credit cards, to determine if a title loan is the best choice for your situation.

#### Conclusion

In times of financial need, **Tennessee title loans in Bristol, Tennessee** can provide a fast and accessible solution. By leveraging your vehicle's title, you can unlock the cash you need without the hassle of credit checks or lengthy approval processes. However, it's crucial to weigh the pros and cons carefully and ensure that you understand the terms of the loan before proceeding. With the right approach, you can navigate your financial challenges effectively and get back on track.