Understanding Home Equity Loan Rates in Delaware: A Comprehensive Guide for Homeowners

Guide or Summary:Home Equity Loan Rates DelawareFactors Influencing Home Equity Loan RatesHow to Secure the Best Home Equity Loan RatesWhat to Consider Befo……

Guide or Summary:

- Home Equity Loan Rates Delaware

- Factors Influencing Home Equity Loan Rates

- How to Secure the Best Home Equity Loan Rates

- What to Consider Before Taking Out a Home Equity Loan

Home Equity Loan Rates Delaware

When it comes to financing options for homeowners in Delaware, understanding home equity loan rates Delaware is crucial. Home equity loans allow homeowners to borrow against the equity they have built in their property, providing a valuable source of funds for various needs, such as home renovations, debt consolidation, or major purchases. In this guide, we will explore the factors influencing home equity loan rates in Delaware, how to secure the best rates, and what homeowners should consider before taking out a loan.

Factors Influencing Home Equity Loan Rates

Several factors can impact home equity loan rates Delaware. The most significant of these include:

1. **Credit Score**: Lenders typically assess the borrower's creditworthiness through their credit score. A higher credit score generally results in lower interest rates, as it indicates to lenders that the borrower is less of a risk.

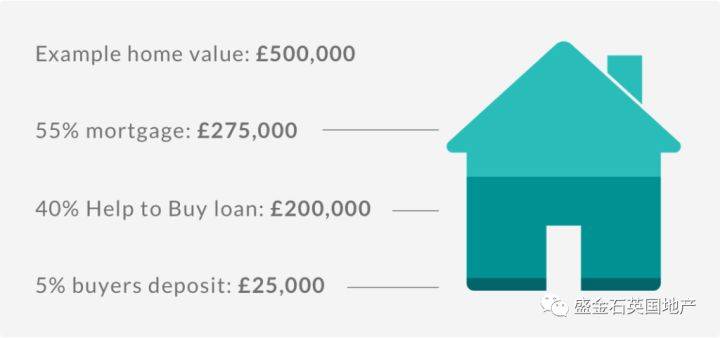

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the amount of the loan to the appraised value of the home. A lower LTV ratio may lead to better rates because it indicates that the homeowner has a substantial amount of equity in their property.

3. **Market Conditions**: Economic factors such as inflation, the Federal Reserve's interest rate policies, and overall market trends can influence home equity loan rates. Keeping an eye on these trends can help homeowners time their loan applications for optimal rates.

4. **Loan Amount and Term**: The size of the loan and the repayment term can also affect rates. Generally, shorter-term loans may have lower interest rates, while larger loan amounts may come with higher rates due to increased risk for the lender.

How to Secure the Best Home Equity Loan Rates

To find the most favorable home equity loan rates Delaware, homeowners should consider the following strategies:

1. **Shop Around**: Different lenders offer varying rates and terms. It's essential to compare offers from multiple banks, credit unions, and online lenders to find the best deal.

2. **Improve Your Credit Score**: Before applying for a home equity loan, take steps to improve your credit score. This may include paying down existing debts, making timely payments, and correcting any errors on your credit report.

3. **Consider a Fixed vs. Variable Rate**: Home equity loans can come with either fixed or variable interest rates. A fixed rate provides stability, while a variable rate may start lower but can fluctuate over time. Homeowners should weigh their options based on their financial situation and risk tolerance.

4. **Consult with a Financial Advisor**: A financial advisor can provide personalized advice based on your financial goals and circumstances. They can help you navigate the complexities of home equity loans and make informed decisions.

What to Consider Before Taking Out a Home Equity Loan

Before proceeding with a home equity loan, homeowners should carefully evaluate their financial situation and long-term goals. Here are some considerations:

1. **Repayment Ability**: Ensure that you can comfortably afford the monthly payments, especially if you are taking on additional debt.

2. **Potential Risks**: Remember that a home equity loan is secured by your home. If you fail to make payments, you risk foreclosure.

3. **Purpose of the Loan**: Clearly define the purpose of the loan and ensure it aligns with your financial goals. Using the funds for high-return investments, such as home improvements, can be beneficial, while using them for non-essential expenses may not be wise.

In conclusion, understanding home equity loan rates Delaware is essential for homeowners looking to leverage their home equity. By considering the factors that influence rates, shopping around for the best offers, and carefully evaluating financial circumstances, homeowners can make informed decisions that benefit their financial future.