Understanding USDA Rural Home Loan Qualifications: Your Guide to Eligibility and Benefits

Guide or Summary: Location Income Limits Creditworthiness Citizenship Status Loan Purpose No Down Payment Competitive Interest Rates Flexible Credit Guideli……

Guide or Summary:

- Location

- Income Limits

- Creditworthiness

- Citizenship Status

- Loan Purpose

- No Down Payment

- Competitive Interest Rates

- Flexible Credit Guidelines

- Mortgage Insurance

- Research Eligible Areas

- Check Income Eligibility

- Find a Lender

- Gather Documentation

- Submit Your Application

#### Introduction to USDA Rural Home Loan Qualifications

The **USDA Rural Home Loan Qualifications** are essential for anyone considering purchasing a home in rural areas of the United States. These loans, backed by the United States Department of Agriculture, aim to promote homeownership in less densely populated regions. Understanding the qualifications can open doors for many potential homeowners who may not qualify for traditional financing.

#### Key Eligibility Requirements

To qualify for a USDA Rural Home Loan, applicants must meet several criteria:

1. Location

The property must be located in a designated rural area as defined by the USDA. While "rural" may conjure images of remote farms, many eligible areas are actually suburban in nature, making this program accessible to a wider audience.

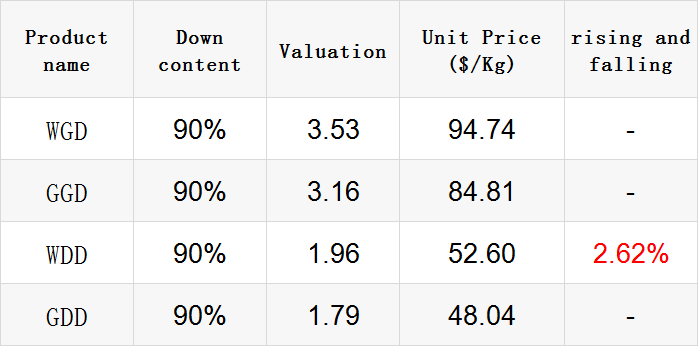

2. Income Limits

USDA loans are designed for low to moderate-income households. Applicants must have an income that does not exceed 115% of the median income for their area. This ensures that the program assists those who truly need financial support.

3. Creditworthiness

While USDA loans are more flexible than conventional loans, a decent credit score is still necessary. Generally, a score of 640 or higher is preferred, but exceptions may be made based on individual circumstances.

4. Citizenship Status

Applicants must be U.S. citizens, non-citizen nationals, or qualified aliens. This requirement ensures that the program is available to those who have a legal right to reside in the United States.

5. Loan Purpose

The loan must be used for purchasing a primary residence. This means that investment properties or second homes do not qualify for USDA financing.

#### Benefits of USDA Loans

Understanding the **USDA Rural Home Loan Qualifications** also reveals the numerous benefits associated with these loans:

1. No Down Payment

One of the most attractive features of USDA loans is the zero down payment requirement, making homeownership accessible for those who may struggle to save for a traditional down payment.

2. Competitive Interest Rates

USDA loans typically come with lower interest rates compared to conventional loans, which can save borrowers significant amounts over the life of the loan.

3. Flexible Credit Guidelines

As mentioned, USDA loans are more lenient regarding credit scores, allowing those with less-than-perfect credit to qualify.

4. Mortgage Insurance

While USDA loans do require mortgage insurance, the rates are generally lower than those for FHA loans, making them a cost-effective option.

#### Application Process

To apply for a USDA loan, potential borrowers should follow these steps:

1. Research Eligible Areas

Start by researching which areas qualify for USDA financing. The USDA website provides a tool to help identify eligible locations.

2. Check Income Eligibility

Use the USDA income eligibility calculator available on their website to determine if your household income meets the necessary limits.

3. Find a Lender

Locate a lender who is approved to offer USDA loans. Many banks and credit unions provide this service, and it’s essential to shop around for the best rates and terms.

4. Gather Documentation

Prepare necessary documents, including proof of income, credit history, and identification. Being organized can expedite the application process.

5. Submit Your Application

Once you have all your documents ready, submit your application to the lender. They will guide you through the process and keep you informed about your loan status.

#### Conclusion

In summary, understanding the **USDA Rural Home Loan Qualifications** is crucial for potential homebuyers looking to take advantage of this beneficial program. With its unique advantages and relatively lenient requirements, the USDA loan is an excellent option for those seeking to purchase homes in rural areas. By meeting the qualifications and following the application process, you can move one step closer to achieving your dream of homeownership.