Understanding Construction Loan Rates: What You Need to Know for Your Next Project

Guide or Summary:Construction Loan RatesFactors Influencing Construction Loan RatesTypes of Construction LoansHow to Secure the Best Construction Loan Rates……

Guide or Summary:

- Construction Loan Rates

- Factors Influencing Construction Loan Rates

- Types of Construction Loans

- How to Secure the Best Construction Loan Rates

Construction Loan Rates

When embarking on a new building project, understanding construction loan rates is crucial. These rates can significantly impact your overall project budget and financing strategy. Construction loans are short-term loans used to finance the building of a home or other real estate projects. Unlike traditional mortgages, which are typically long-term loans, construction loans are designed to cover the costs associated with the construction process, which can last several months to a few years.

Factors Influencing Construction Loan Rates

Several factors influence construction loan rates, including the type of loan, the lender, the borrower's creditworthiness, and the project's location. Lenders assess the risk involved in financing a construction project, which means that borrowers with higher credit scores may qualify for lower rates. Additionally, the type of construction loan can affect the interest rate; for example, a fixed-rate construction loan may have a different rate compared to a variable-rate option.

Types of Construction Loans

There are various types of construction loans available, each with its own set of construction loan rates. The most common types include:

1. **Construction-to-Permanent Loans**: These loans convert into a permanent mortgage once the construction is complete. They often have lower rates since they provide a seamless transition from construction to permanent financing.

2. **Stand-Alone Construction Loans**: These are short-term loans that cover only the construction phase. Borrowers will need to secure a separate mortgage once the project is finished, which can lead to higher costs if rates rise during the interim.

3. **Owner-Builder Loans**: For those planning to act as their own general contractor, these loans can be more challenging to obtain and may come with higher construction loan rates due to the increased risk perceived by lenders.

How to Secure the Best Construction Loan Rates

To secure the best construction loan rates, borrowers should follow several key strategies:

- **Improve Your Credit Score**: Before applying for a construction loan, take steps to improve your credit score. Pay off existing debts, make timely payments, and avoid taking on new debt.

- **Shop Around**: Different lenders offer varying rates and terms. It’s essential to compare multiple lenders to find the most favorable construction loan rates.

- **Consider Loan Terms**: A shorter loan term may come with lower rates, but it also means higher monthly payments. Evaluate your financial situation to determine what works best for you.

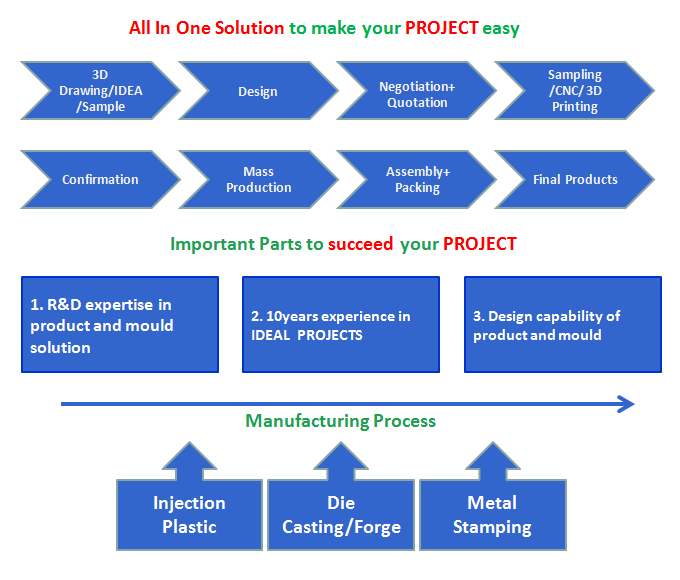

- **Provide a Solid Project Plan**: Lenders are more likely to offer competitive rates if you present a well-thought-out construction plan, including detailed budgets and timelines.

Understanding construction loan rates is essential for anyone looking to finance a building project. By considering the factors that influence these rates, exploring different loan types, and taking proactive steps to secure the best rates, borrowers can make informed decisions that align with their financial goals. Whether you are building a new home or undertaking a commercial project, being well-informed about construction loan rates can help you navigate the complexities of construction financing and set your project up for success.