Maximizing Your Home Equity Loan: Understanding the Importance of Your Credit Score

Guide or Summary:What is a Home Equity Loan?Why Your Credit Score MattersImproving Your Credit ScoreWhen considering a home equity loan credit score, it’s e……

Guide or Summary:

When considering a home equity loan credit score, it’s essential to grasp how your credit score can significantly influence your loan options and terms. A home equity loan allows homeowners to borrow against the equity they’ve built up in their property, often leading to lower interest rates compared to other types of loans. However, lenders heavily weigh your credit score when determining your eligibility and the interest rate you’ll receive.

What is a Home Equity Loan?

A home equity loan is a type of second mortgage that allows you to borrow against the equity in your home. Equity is the difference between what your home is worth and what you owe on your mortgage. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. Lenders will typically allow you to borrow a percentage of that equity, often up to 85%.

Why Your Credit Score Matters

Your home equity loan credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. A higher score indicates a lower risk to lenders, which can result in better loan terms. Lenders use your credit score to assess your ability to repay the loan, and a score of 700 or above is generally considered good. Here’s how your credit score impacts your home equity loan:

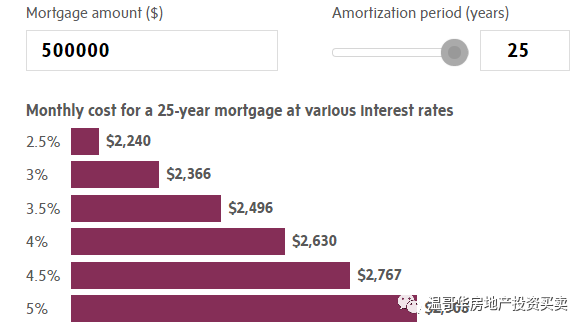

1. **Interest Rates**: Borrowers with higher credit scores often qualify for lower interest rates, which can save you thousands over the life of the loan.

2. **Loan Amount**: A better credit score can increase the amount you’re eligible to borrow, allowing you to access more of your home’s equity.

3. **Approval Chances**: If your credit score is below 620, you may struggle to get approved for a home equity loan. Lenders may view you as a higher risk, leading to denial or unfavorable terms.

Improving Your Credit Score

If you’re considering a home equity loan, it’s wise to check your credit score and take steps to improve it if necessary. Here are some strategies to boost your score:

- **Pay Your Bills on Time**: Payment history is a significant factor in your credit score. Consistently paying bills on time can positively impact your score.

- **Reduce Credit Utilization**: Aim to keep your credit card utilization below 30%. This means if you have a $10,000 credit limit, you should keep your balance below $3,000.

- **Avoid New Debt**: Opening new credit accounts can lower your score temporarily, so avoid taking on new debt before applying for a home equity loan.

- **Check Your Credit Report**: Regularly review your credit report for errors and dispute any inaccuracies you find.

In conclusion, understanding the role of your home equity loan credit score is crucial when considering borrowing against your home’s equity. A strong credit score can open the door to better loan options, lower interest rates, and higher borrowing limits. By taking proactive steps to improve your credit score, you can position yourself for a successful home equity loan experience. Whether you’re looking to consolidate debt, finance a major purchase, or make home improvements, being informed about your credit score can make all the difference in securing the best possible terms for your loan.