"Ultimate Guide to Using a Credit Car Loan Calculator for Smart Financing Decisions"

Guide or Summary:Understanding the Basics of a Credit Car Loan CalculatorHow to Use a Credit Car Loan CalculatorThe Importance of a Credit Car Loan Calculat……

Guide or Summary:

- Understanding the Basics of a Credit Car Loan Calculator

- How to Use a Credit Car Loan Calculator

- The Importance of a Credit Car Loan Calculator

- Common Mistakes to Avoid When Using a Credit Car Loan Calculator

**Credit Car Loan Calculator** (信用汽车贷款计算器)

When it comes to purchasing a vehicle, understanding your financing options is crucial. One of the most valuable tools at your disposal is a **credit car loan calculator**. This tool allows potential car buyers to estimate their monthly payments, understand interest rates, and get a clearer picture of how much they can afford. In this guide, we will explore how to effectively use a credit car loan calculator and why it is essential for making informed financial decisions.

Understanding the Basics of a Credit Car Loan Calculator

A **credit car loan calculator** is an online tool designed to help you estimate your monthly car loan payments based on various factors. These factors typically include the loan amount, interest rate, loan term, and your credit score. By inputting these details, the calculator provides a quick estimate of what your monthly payments will look like, helping you budget accordingly.

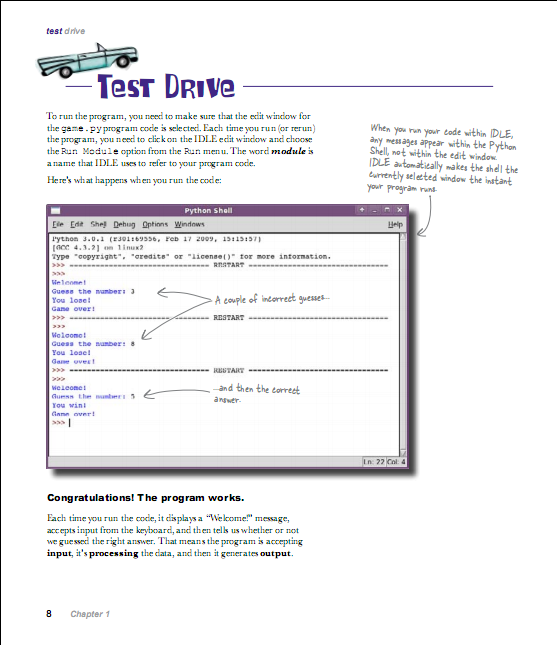

How to Use a Credit Car Loan Calculator

Using a **credit car loan calculator** is straightforward. Here’s a step-by-step guide:

1. **Determine the Loan Amount**: Start by deciding how much you need to borrow. This amount can include the price of the car, taxes, fees, and any additional costs.

2. **Input the Interest Rate**: Research the current interest rates for auto loans. Your credit score will significantly influence this rate, so it’s important to know where you stand.

3. **Select the Loan Term**: Choose how long you want to finance the car. Common terms are 36, 48, 60, or even 72 months. Keep in mind that longer terms may lower your monthly payments but can increase the total interest paid over time.

4. **Enter Your Credit Score**: If the calculator allows, input your credit score to get a more accurate interest rate.

5. **Calculate**: After entering all the necessary information, click the calculate button. The calculator will display your estimated monthly payment, total interest paid, and total loan cost.

The Importance of a Credit Car Loan Calculator

Using a **credit car loan calculator** is important for several reasons:

- **Budgeting**: It helps you understand what you can afford, preventing you from overextending your finances.

- **Comparing Loan Options**: You can adjust the loan amount, interest rate, and term to see how different scenarios affect your monthly payments.

- **Negotiation Power**: Knowing your estimated payments can empower you during negotiations with dealerships or lenders.

- **Financial Planning**: By understanding the total cost of the loan, you can plan your finances better and avoid surprises down the road.

Common Mistakes to Avoid When Using a Credit Car Loan Calculator

While a **credit car loan calculator** is a helpful tool, there are common pitfalls to be aware of:

- **Ignoring Additional Costs**: Remember to factor in taxes, fees, and insurance when determining your budget.

- **Not Considering Your Credit Score**: Your credit score significantly impacts the interest rate. Make sure to check your score before using the calculator.

- **Focusing Solely on Monthly Payments**: While it’s important to know your monthly payment, also consider the total cost of the loan over its lifetime.

A **credit car loan calculator** is an essential tool for anyone looking to finance a vehicle. By understanding how to use it effectively, you can make informed decisions that align with your financial goals. Whether you are a first-time buyer or looking to upgrade your current vehicle, utilizing this calculator will help you navigate the complexities of auto financing with confidence.