Understanding Credit Card Consolidation Loan Rates: How to Find the Best Options for Your Financial Needs

Guide or Summary:What is a Credit Card Consolidation Loan?Why Consider Consolidation?Factors Influencing Credit Card Consolidation Loan RatesHow to Find the……

Guide or Summary:

- What is a Credit Card Consolidation Loan?

- Why Consider Consolidation?

- Factors Influencing Credit Card Consolidation Loan Rates

- How to Find the Best Credit Card Consolidation Loan Rates

- The Application Process

**Credit Card Consolidation Loan Rates** (信用卡合并贷款利率)

In today's financial landscape, many individuals find themselves overwhelmed with multiple credit card debts, each with varying interest rates and payment deadlines. This situation often leads to confusion and stress, making it challenging to manage finances effectively. One viable solution to this problem is a credit card consolidation loan. Understanding **credit card consolidation loan rates** is crucial for anyone considering this option.

What is a Credit Card Consolidation Loan?

A credit card consolidation loan is a type of personal loan that allows you to combine multiple credit card debts into a single loan. This can simplify your financial obligations by reducing the number of payments you need to make each month. Instead of juggling several credit card bills, you will only have one monthly payment to manage.

Why Consider Consolidation?

Consolidating your credit card debt can offer several benefits. Firstly, it may help you secure a lower interest rate compared to the rates on your existing credit cards. Lower interest rates can significantly reduce the total amount you pay over time, making it easier to pay off your debt. Additionally, a single payment can help you avoid missed payments, which can lead to late fees and further damage to your credit score.

Factors Influencing Credit Card Consolidation Loan Rates

When considering a credit card consolidation loan, it’s essential to understand the factors that influence the loan rates. Lenders typically evaluate your credit score, income, debt-to-income ratio, and overall financial history. A higher credit score usually translates to lower interest rates, while a lower score may result in higher rates. It’s advisable to check your credit report and address any discrepancies before applying for a consolidation loan.

How to Find the Best Credit Card Consolidation Loan Rates

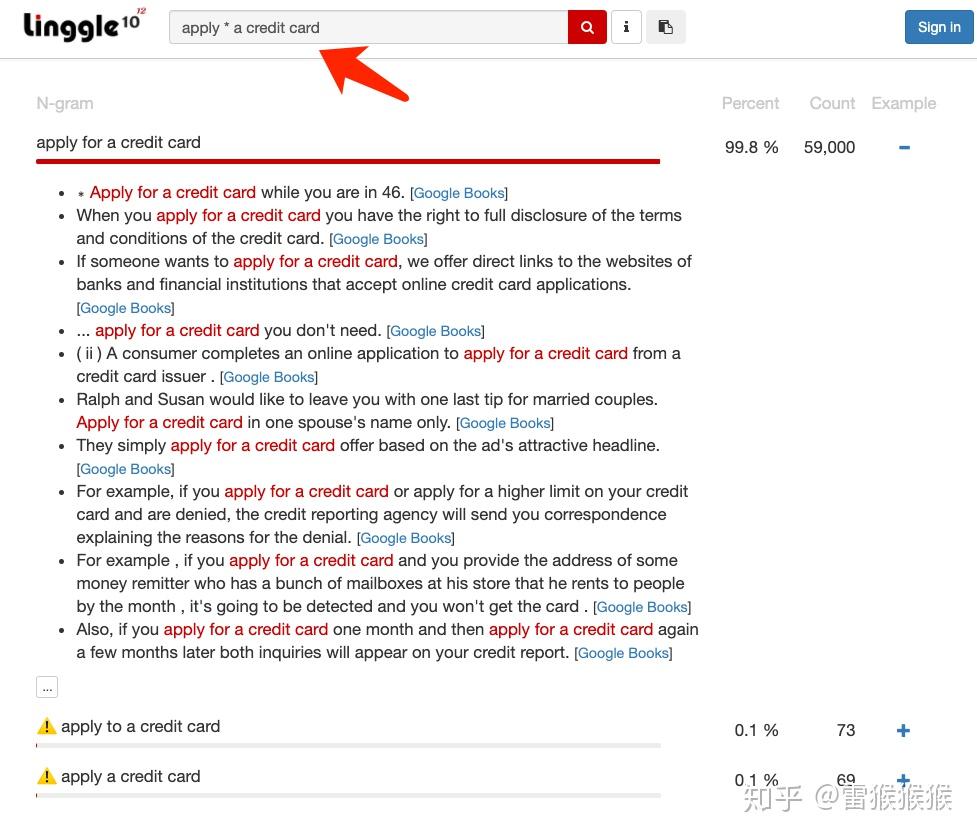

To find the best **credit card consolidation loan rates**, start by researching various lenders, including banks, credit unions, and online lenders. Each lender will have different criteria and rates, so it’s essential to compare offers. Look for lenders that provide prequalification options, allowing you to see potential rates without impacting your credit score.

Additionally, consider the loan terms, such as the repayment period and any associated fees. A loan with a lower interest rate but high fees may not be the best option. Always read the fine print and understand the total cost of the loan before making a decision.

The Application Process

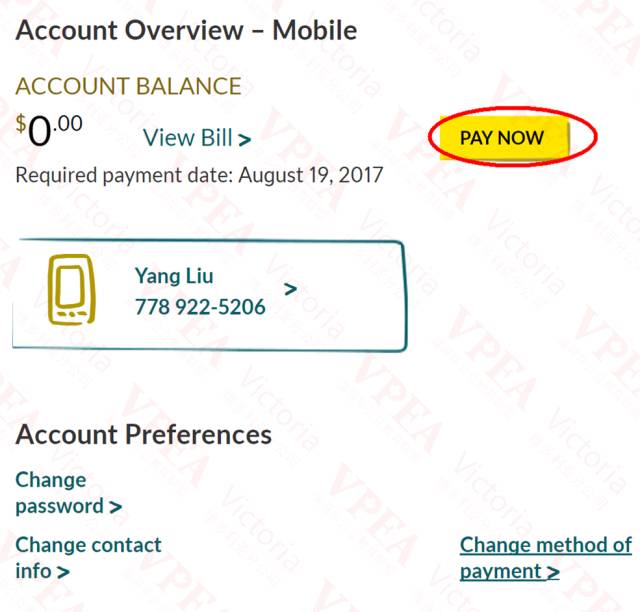

Once you’ve identified potential lenders, the next step is to apply for the loan. This process typically involves submitting personal and financial information, including your income, employment details, and existing debts. After reviewing your application, the lender will provide you with a loan offer, including the interest rate and terms.

In conclusion, understanding **credit card consolidation loan rates** is vital for anyone looking to manage their credit card debt effectively. By consolidating your debts, you can simplify your payments, potentially lower your interest rates, and ultimately take control of your financial situation. Always do your research, compare offers, and choose a loan that best fits your financial needs. With the right approach, you can pave the way toward financial stability and peace of mind.