Discover the Best Loan Companies Like Upstart for Your Financial Needs

#### Introduction to Loan Companies Like UpstartIn today's fast-paced financial landscape, finding the right loan company can be a daunting task. Many indiv……

#### Introduction to Loan Companies Like Upstart

In today's fast-paced financial landscape, finding the right loan company can be a daunting task. Many individuals seek alternatives to traditional banks, and loan companies like Upstart have emerged as popular options. These companies leverage technology and data-driven approaches to provide personal loans, making the borrowing process more accessible and efficient.

#### What Sets Loan Companies Like Upstart Apart?

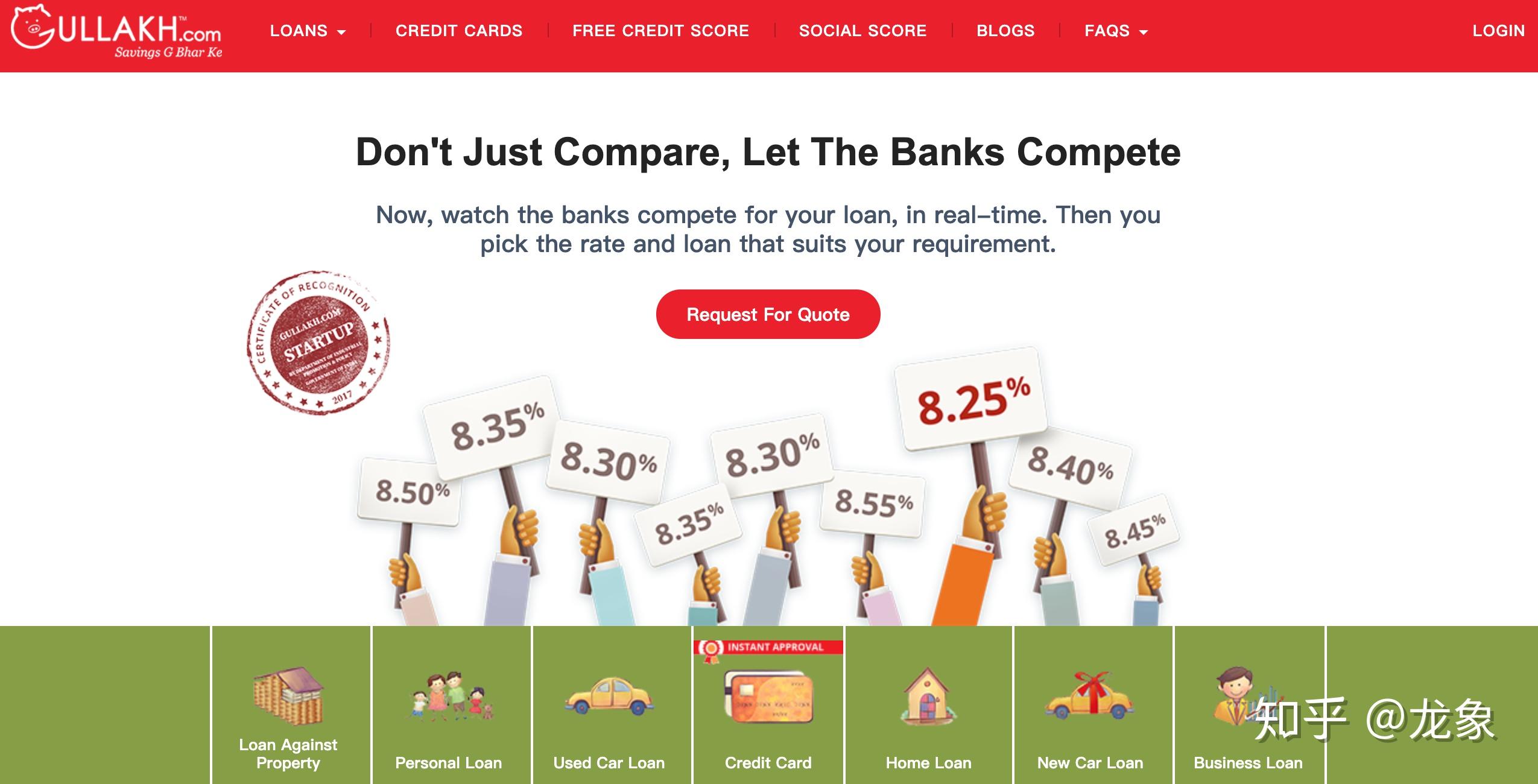

Loan companies like Upstart stand out due to their innovative use of artificial intelligence and machine learning algorithms. Unlike traditional lenders that primarily rely on credit scores, these companies evaluate potential borrowers based on a broader range of factors, including education, employment history, and income potential. This approach enables them to offer loans to individuals who may have limited credit histories or lower credit scores, thus expanding access to credit.

#### Benefits of Choosing Loan Companies Like Upstart

1. **Quick and Easy Application Process**: Loan companies like Upstart typically offer a streamlined online application process. Borrowers can complete their applications in a matter of minutes, often receiving approval within hours. This efficiency is a significant advantage for those in need of urgent financial assistance.

2. **Flexible Loan Options**: Many loan companies like Upstart provide a variety of loan amounts and terms, allowing borrowers to choose what best fits their financial situation. Whether you need a small personal loan or a larger sum for a significant expense, these companies can cater to your needs.

3. **Competitive Interest Rates**: Loan companies like Upstart often offer competitive interest rates compared to traditional lenders. By using advanced algorithms to assess risk, they can provide fair rates that reflect an individual’s unique financial profile.

4. **No Prepayment Penalties**: Many loan companies, including Upstart, allow borrowers to pay off their loans early without incurring penalties. This flexibility can save borrowers money on interest payments and help them achieve financial freedom sooner.

#### How to Choose the Right Loan Company Like Upstart

When searching for loan companies like Upstart, it’s essential to consider several factors:

- **Reputation**: Research the company's reputation by reading customer reviews and checking ratings on platforms like the Better Business Bureau (BBB).

- **Transparency**: Look for companies that are transparent about their fees, interest rates, and loan terms. A reputable lender will provide clear information upfront without hidden charges.

- **Customer Service**: Excellent customer service can make a significant difference in your borrowing experience. Choose a company that offers responsive support and is willing to assist you throughout the loan process.

- **Loan Terms**: Compare the loan terms offered by different companies. Look for flexible repayment options and favorable conditions that align with your financial goals.

#### Conclusion

In conclusion, loan companies like Upstart have revolutionized the lending landscape by offering accessible and efficient financial solutions. With their innovative approach, they cater to a diverse range of borrowers, providing a viable alternative to traditional banks. By understanding the benefits and carefully evaluating your options, you can find the right loan company that meets your financial needs. Whether you’re looking to consolidate debt, cover unexpected expenses, or fund a personal project, exploring loan companies like Upstart can be a smart move towards achieving your financial goals.